31 Days to a Better Budget

Reducing Discretionary Expenses

Each day of the series offers new tips, ideas and a challenge to start the year with a solid financial plan.

Once you have gotten down the basics—expenses you can’t (or won’t) eliminate, there is still plenty you can do to impact your budget. I’m not talking about giving anything up, this time. At this point, it’s all about finding ways to lower discretionary costs—things like clothing, travel, entertainment and even food. Yes, food. It’s for sure not an optional expense, but how & where you spend money on food makes all the difference to your wallet.

For the next couple weeks, we’re moving past bills and into spending categories. We’ll specifically discuss creating a grocery budget, ways to reduce dining costs, saving money on clothing and lowering travel expenses (including gas!). You’ll learn when not to spend money and how to shop smarter when you do.

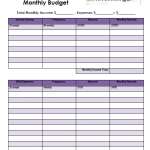

Today’s challenge is a simple one. Make a list of everything pay for on a regular basis. Broad categories are fine. We’re talking about things you spend money on, that don’t come as a bill in the mail—food, clothes, gifts, date night, vacations, entertainment…

It’s going to be a really long list!

If you have sorted receipts, or if you’ve been tracking expenses, the next step will be easy. Write down how much you spend on each category, then order them from highest to lowest. If you don’t have the numbers, you can estimate for now (but keep track for the rest of the month so you can readjust, as needed).

Whether you utilize the envelope system, track purchases with Mint or have your own way of doing things, set a new (lower) number and stick. with. it. Start small, be realistic and make efforts to minimize consumption & spending. Our immediate goal is to lower each category by 10%—though, you can cut many categories by as much as 50%! (Or more—we cut our fast food budget by 90% the first time we tackled this exercise.)

The largest numbers are where you want to concentrate your efforts the most—partly because it’s such a big chunk of your budget, and partly because there’s more wiggle room. I’m guessing groceries and/or dining are somewhere at the top of your list—you’ve gotta eat! Tomorrow, we’ll share tips for making changes in your shopping habits to lower your grocery budget.

I’m not a financial planner or a budget expert. I’ll just be walking you through the steps I take each time my budget needs an adjustment. In fact, I’ll be participating myself!

31 Day Budget (Day 5): Tracking Expenses

31 Day Budget (Day 5): Tracking Expenses 31 Day Budget (Day 14): Budget Dining Out

31 Day Budget (Day 14): Budget Dining Out 31 Day Budget (Day 6): Creating a Monthly Budget

31 Day Budget (Day 6): Creating a Monthly Budget 31 Day Budget (Day 13): Budget Grocery Shopping

31 Day Budget (Day 13): Budget Grocery Shopping

In order to retire I need to pay off debt. I would appreciate all good ideas.