31 Days to a Better Budget

Making Tough Decisions

Each day of the series offers new tips, ideas and a challenge to start the year with a solid financial plan.

Yesterday, we looked at little leaks—small expenses you can eliminate from the budget without much difference in your lifestyle. Today, we’re going to take a look at the bigger things. What’s the most expensive item on your list? Well, besides housing—though, that might be something to consider. If you’re renting, can you find a smaller, less expensive place? If you own, can you adjust your home owner’s insurance, eliminate your PMI or even look into a refinance?

When you really want to have an imact on your family’s bottom line, you’ll have to dig into those bigger numbers. This month, I’m taking a closer look at our cell phone bill. It’s gotten a little out of hand recently, between two smart phones, the teen’s phone and a couple extra lines for home & work. I’ll be challenging my thinking on this one—is our current carrier really the best choice for us? I’ve spent the last several weeks with a demo Droid from Verizon.

This iPhone user was surprised by how very much I love it. The 3G service experience was beyond anything I’ve had access to before. Since it wasn’t programmed to my personal number, I honestly didn’t use the actual calls or texting much, but I am now confident a carrier change would result in no lifestyle change. One of the things we’re doing as we readjust our budget is checking the dates of our contracts and comparing prices to see if a switch would be beneficial.

It’s also time to seriously discuss the difference between needs & wants. You may need clothes, but you only want those hot new boots. Your family needs to eat, but you only want to order pizza on Friday night, or dine at your favorite restaurant Sunday afternoon. So many things get pushed onto the need list, when they are really an indulgence.

These “new necessities” can account for a significant amount of your monthly expenses. One of the interesting things on the list, for me, was a 2nd car. I remember when my car died several years ago. We didn’t really have the money to repair or replace it. As a stay-at-home mom, I didn’t really need a car, so we donated my car for the tax write off and became a single car family.

Once or twice a week, I got up early, took the hubby to work and used the car for the day. No, it wasn’t super convenient, but a car payment would have been even more inconvenient. We occasionally discuss the idea of selling his car again and sticking with my van as the sole family vehicle, though we don’t have a car payment. He works a little farther away now, which makes it a little more difficult, but it’s an option we have, should we ever need an influx of cash.

What changes can you make? Pick one major expense in your budget, and start looking for ways to lower your costs. We’ll be tackling several common areas next week, but for today, just think long & hard about where your money is going. Challenge your assumptions, and decide where you want to focus your energy with trying new money saving ideas.

Verizon loaned me a Droid X demo device for 6 weeks, after a local event for bloggers. I received no compensation for this post, and all opinions are 100% mine.

I’m not a financial planner or a budget expert. I’ll just be walking you through the steps I take each time my budget needs an adjustment. In fact, I’ll be participating myself!

31 Day Budget (Day 13): Budget Grocery Shopping

31 Day Budget (Day 13): Budget Grocery Shopping 31 Day Budget (Day 4): Identifying Priorities

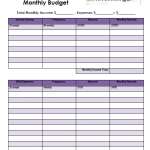

31 Day Budget (Day 4): Identifying Priorities 31 Day Budget (Day 6): Creating a Monthly Budget

31 Day Budget (Day 6): Creating a Monthly Budget

[…] you start shopping, make sure to evaluate what your needs and wants are. Remember it’s not a great deal unless you can afford to buy it! Evaluate your shopping […]