31 Days to a Better Budget

Plugging in the Numbers

Each day of the series offers new tips, ideas and a challenge to start the year with a solid financial plan.

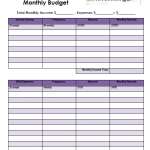

We’re working through the budget plan step by step—breaking down the process to make it easier to deal with (both literally and figuratively). Now that you have organized paperwork & sorted bills, it’s time to start tackling the numbers. Whether you use budgeting software, a spreadsheet program or our budget worksheets, start plugging in the information from the paperwork you’ve sorted through.

Yes, we’re looking at the amounts this time!

Don’t freak out—we’ll get to working it all out later. For now, just get the information organized so you can sort out your assets, insurance information, debt load and household payments. Start with a single stack from yesterday’s challenge. Make note of recurring bills, fluctuating bills and one-time bills as you go.

Assets & Income: include balances for all accounts—checking, savings, CD, 401K investment, etc—as well as income

Household Payments: include all utilities, regular payments, occasional expenses, etc (don’t forget annual things like vehicle registration & HOA dues)

Insurance: include all insurance accounts, both for record keeping and as a way to keep track of your payments

Debt Management: include all debt—credit cards, store cards, loans, vehicles, mortgages, student loans, etc

This will help pave the way for creating a monthly budget, as we continue the series.

I’m not a financial planner or a budget expert. I’ll just be walking you through the steps I take each time my budget needs an adjustment. In fact, I’ll be participating myself!

31 Day Budget (Day 2): Sorting Your Finance

31 Day Budget (Day 2): Sorting Your Finance 31 Day Budget (Day 6): Creating a Monthly Budget

31 Day Budget (Day 6): Creating a Monthly Budget 31 Day Budget (Day 30): Spending “Bonus” Money

31 Day Budget (Day 30): Spending “Bonus” Money 31 Day Budget (Day 1): Getting Organized

31 Day Budget (Day 1): Getting Organized

Oh my goodness! Amazing article dude! Many thanks, However I am encountering difficulties

with your RSS. I don’t know the reason why I can’t subscribe to it.

Is there anybody getting the same RSS issues? Anyone that knows the

solution can you kindly respond? Thanks!!